학부모민원갑질사례

평범한 선생님은 말을 하고, 좋은 선생님은 설명을 하며, 뛰어난 선생님은 몸소 보여주고, 위대한 선생님은 영감을 준다

Also if you have a valid factor for a will certainly dispute after probate, you may find several challenges to take care of. While there are many ways to contest a will, not every one of them are very easy to supply or worth the effort. Some reasons for testing the will stand and less complicated to verify. An additional basis is excessive impact, where an individual in a setting of count on coerces the testator, overpowering their free will and pushing them to change the will. A challenger can additionally allege scams, where the testator was deceived right into finalizing, or imitation, where the will certainly or signature is a construct

Also if you have a valid factor for a will certainly dispute after probate, you may find several challenges to take care of. While there are many ways to contest a will, not every one of them are very easy to supply or worth the effort. Some reasons for testing the will stand and less complicated to verify. An additional basis is excessive impact, where an individual in a setting of count on coerces the testator, overpowering their free will and pushing them to change the will. A challenger can additionally allege scams, where the testator was deceived right into finalizing, or imitation, where the will certainly or signature is a constructThe information you obtain at this site is not, nor is it intended to be, lawful suggestions. You need to consult an attorney for guidance concerning your individual scenario. We invite you to call us and invite your telephone calls, letters and e-mail. Please do not send out any kind of confidential information to us until such time as an attorney-client partnership has been developed. One opportunity is the extension of business by one or more of the heirs.

Navigating Joblessness Insurance Claims For Entrepreneur In Texas

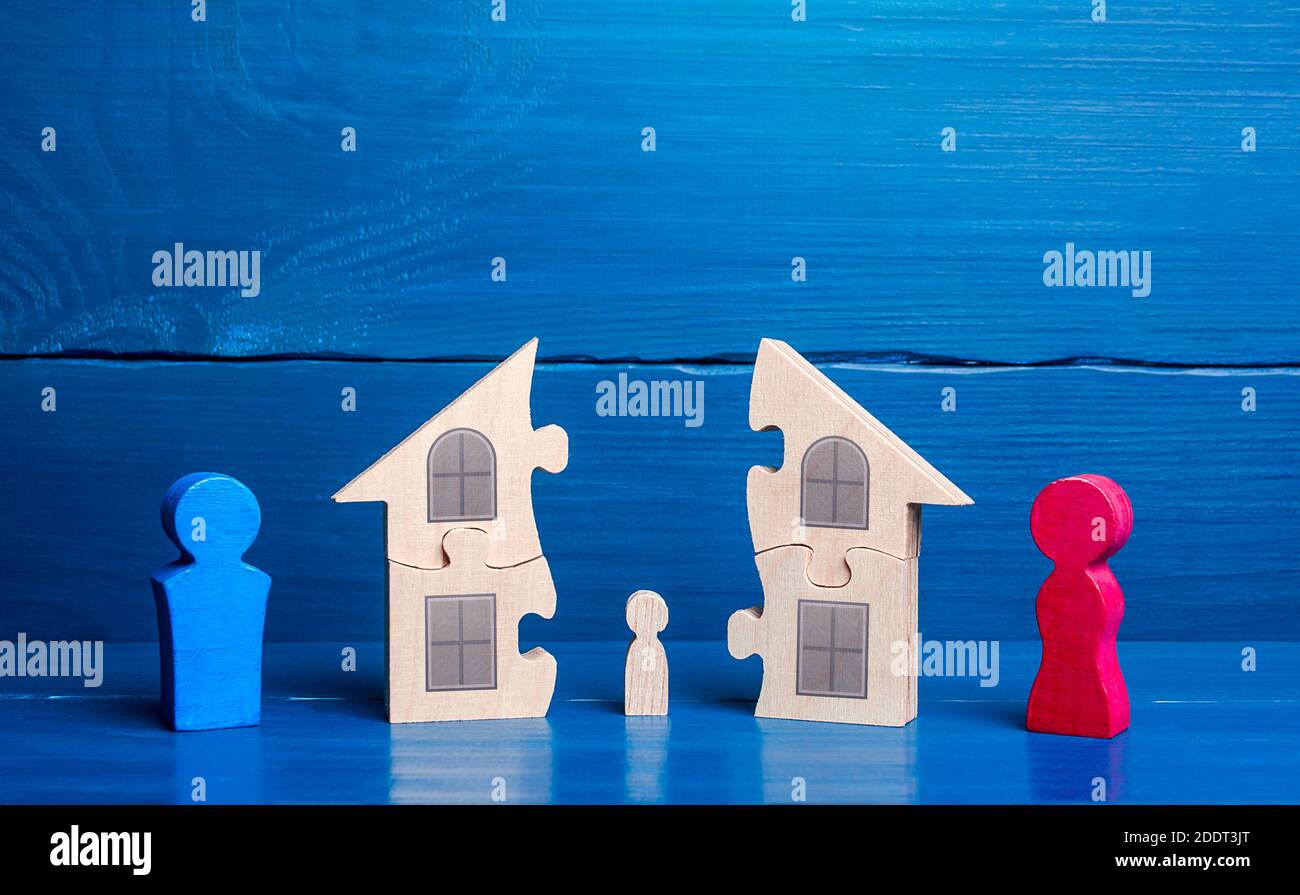

Without preparation, considerable worth in business will merely be lost due to an owner's fatality. Furthermore, the unexpected death of a business can often trigger the heirs a large amount of trouble and issues which could otherwise be prevented. Even in simple scenarios, some preparation must be done to resolve the dissolution of an organization on the death of a proprietor. In a similar way, any entrepreneur or companion who remarries or has a blended family members must be totally transparent. Sometimes, this might suggest securing their biological children's inheritance; in various other cases, it indicates plainly mentioning the succession of particular assets, interests, or shares to a brand-new spouse and step-children. If you are planning to pass business on a certain person or individuals, this should be plainly specified.

What Occurs To A Sole Proprietorship When The Proprietor Passes Away?

There are no guarantees that dealing with an advisor will certainly produce favorable returns. The existence of a fiduciary obligation does not stop the rise of potential problems of interest. Our expert commercial team would certainly be happy to talk about these and any other service concerns in full confidence.

Development health care regulations and powers of attorney take care of medical care and monetary choices if you become incapacitated. When you companion with Avidian, you're not simply planning for the future generation-- you're preparing for your life's job to endure. In lots of tiny and mid-sized firms, the proprietor is the heart of the business. When they pass away without determining and preparing a successor, the leadership void can create chaos. Employees may be perplexed, operations may stall, and customers may transform to rivals.

The new policies relate to fundings released between Dec. 31, 2017, and Jan. 1, 2026. A 2018 government law requires lending institutions to launch co-signers from their funding responsibility if the trainee debtor dies. Nevertheless, loans obtained before 2018 aren't subject to this regulation and might have various rules. If the key customer passes away, the lender normally will discharge the co-signer's responsibility to pay off the funding.

What Occurs To Organization Financial Obligation When The Owner Dies?

Yes, creating a will certainly becomes much more essential as your revenue and possessions expand. High earners frequently have intricate economic situations including stock choices, several homes, and https://www.khuifx.com/ substantial retirement accounts that call for details circulation instructions. Without a will, your state's intestacy regulations can disperse these possessions in manner ins which create unneeded tax obligation problems for your heirs. According to the American Bar Organization, intestate sequence regulations differ significantly by state but generally don't account for modern family members frameworks or tax optimization techniques. After the death of a proprietor, control of the entity after that falls to those called in the person's estate p

As soon as appointed guardian supporter, parents must choose follower guardians for their impaired adult youngsters in their estate preparing files just as they would when their children were still young, under the age of

We assist you through the procedure, ensuring that your trust fund is established correctly to profit your family. More methods people might likewise be pressed into paying tax obligation on their cost savings, by breaching the personal financial savings allocation, which is ₤ 1,000 for basic rate taxpayers. IHT Exceptions and Alleviations are available and can significantly minimize the tax obligation concern. For Lee example, specific gifts and transfers may be exempt from IHT, or alleviations might put on lower the taxable worth of assets.

Direct Offspring

Expert suggestions is the foundation of efficient estate preparation, giving comfort for you and your family. When managing complicated issues such as Nil Rate Band Discretionary Trusts, it's important to consult with experts who can direct you with the process. Picking the best trustees is an important choice when setting up a Nil Price Band Discretionary Depend On. Trustees are in charge of managing the trust fund assets and choosing regarding distributions to recipients. It's critical to choose individuals that are not just credible but also with the ability of taking care of the obligations involved. Optional depends on additionally allow families to maintain control over how their assets are dispersed.

How Trust Funds Fit Into Estate Planning

This type of trust entails allocating an amount matching to the nil price band into an optional trust, supplying various advantages for family members. Nil-rate band discretionary trusts are used by estate-planners to lower obligations to pay inheritance tax on the fatality of enduring joint owners. By comprehending the tax ramifications of a Nil Rate Band Count on, you can better handle your estate and make sure that your liked ones gain from your tradition. We are below to guide you via the process, supplying professional suggestions on revenue tax obligation and resources gains tax to protect your family members's economic future. An optional trust is a flexible tool in estate preparation, supplying flexibility and protection.

By doing so, they can possibly increase the amount of their estate that is exempt from inheritance tax. When the count on action is in location, the next step is to move possessions into the trust. This can include a variety of assets, such as residential property, financial investments, or money. The assets transferred into the trust will certainly be handled by the trustees according to the terms of the trust deed. For beneficiaries, this implies obtaining their inheritance in a tax-efficient fash