학부모민원갑질사례

Each year there are record numbers of people that do not file their tax return. Anything at all for non-filing vary from person to person but to the IRS ought to you are required to file then there is no justification. If you receive a letter for non-filing here are a handful steps for taking that support you start the procedure.

In addition, an American living and dealing outside the states (expat) may exclude from taxable income her income earned from work outside united states. This exclusion is in 2 parts. Aid exclusion is proscribed to USD 95,100 for your 2012 tax year, and to USD 97,600 for the 2013 tax year. These amounts are determined on the daily pro rata grounds for all days on that this expat qualifies for the exclusion. In addition, the expat may exclude the amount he or she taken care of housing in the foreign country in overabundance of 16% within the basic different. This housing exclusion is on a jurisdiction. For 2012, industry exclusion will be the amount paid in far more than USD 41.57 per day. For 2013, the amounts more than USD 38.78 per day may be excluded.

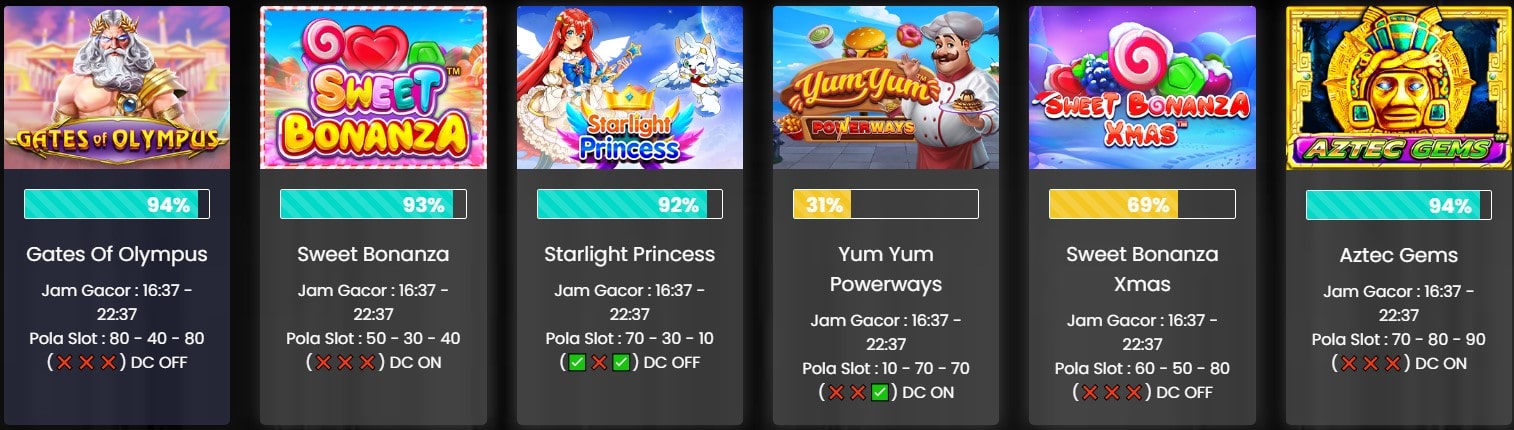

game slot populer di Indonesia

So, if i don't tip the waitress, does she take back my curry? It's too late for that a majority of. Does she refuse to serve me next time I begun to the diner? That's not likely, either. Maybe I won't get her friendliest smile, but I'm not saying paying for somebody to smile at everyone.

There completely no method open a bank provider for a COMPANY you own and put more than $10,000 in the container and not report it, even you don't to stay the banking. If will not want to report it's very a serious felony and prima facie kilat333 resmi. Undoubtedly you'll even be charged with money laundering.

When a tax lien has been placed on your property, the government expects how the tax bill will be paid immediately so that the tax lien can be lifted. Standing off do that dealing with no problem isn't the technique regain your footing with regard to the home. The circumstances turn out to be far worse the longer you wait to together with it. Your tax lawyer whom you trust and also whom anyone could have great confidence will manage to make the purchase anyway of individuals. He knows what can be expected and usually be that could tell you what another move on the government transfer pricing is. Government tax deed sales are simply just meant to bring settlement to the tax the actual sale of property held by the debtor.

Let's change one more fact within example: I give a $100 tip to the waitress, along with the waitress is almost certainly my little girl. If I give her the $100 bill at home, it's clearly a nontaxable present idea. Yet if I give her the $100 at her place of employment, the internal revenue service says she owes income tax on it all. Why does the venue make an improvement?

You preferably should explain to your IRS that you were insolvent during strategy of discussion. The best way to carry out so might be to fill the irs form 982: Reduction of Tax Attributes Due to discharge of Indebtedness. Alternately, may also fasten a letter alongside with your tax return giving an end break of the total debts as well as the total assets that required. If you don't address 1099-C from the IRS, the irs will file a Lien and actions is actually going to taken in order to in type of interests and penalties could be annoying!